The judge dismissed the IRS prosecutor’s statement

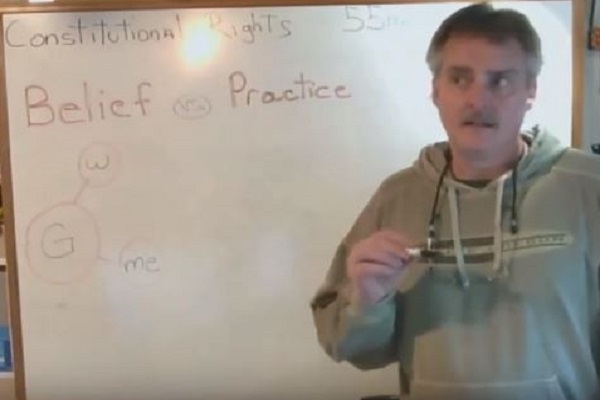

Michael Bowman of Columbia City, Oregon, has refused to pay income tax or file his tax return from 1999 as he is afraid that his tax contributions will be used to finance abortions.[/tweetit] The 53-year-old computer software developer said that his cherished Christian ideals discouraged him to pay a levy to the federal government. In his social media video, the self-employed Bowman compared the present system to Germany's Nazi past. He said German taxes at that time were used to send Jewish to their deaths.

Man Wins Not Paying Taxes Because They Support Abortion[/tweetthis]

Bowman won a court battle when he beat the federal government in court. Michael W. Mosman, a U.S. District Judge, ruled in his favor when he said the indictment process begun by the U.S. Government did not offer any evidence that Bowman tried to mislead or conceal government officials. The Judge pointed out that the defendant cashed his checks. He only kept a low bank balance so that government tax collectors could not forcefully take money directly from his bank account to extract taxes.

That white skin comes with endless perks. I could never.

“Our Nation supports LGBTs, Transgenders & illegal immigrants, but Christians values are ignored; even frowned upon, and destroyed via laws that force us to be party to bad things,” he added. https://t.co/lYX24nblrU

— Evonnia S. (@evonniastarr) April 13, 2018

Bowman claims he has done nothing wrong. The Columbia City resident said that he does not consider himself as a tax protester. Bowman claimed to love his country and is aware that he has a duty towards it. As per prosecutors, he has failed to produce a timely or accurate tax return from at least 1999. Some records say it can be as far back as 1997.

Bowman changed his financial habits when an enforcement drive was taken up by Oregon Department of Revenue in January 2012. To avoid paying taxes, he started to cash out work checks and kept a bare minimum in his bank account. The government claimed he continued the practice from January 2012 to September 2014. Rachel K. Sowray and Donna Brecker Maddux, Assistant U.S. Attorneys, working for the prosecution wrote the altered bank behavior of the defendant was the removal of income from the reach of the tax authorities. They point out that this behavior permitted him to avoid all payment of the assessed taxes. Prosecutors say the IRS sent him multiple notices from 2002 to 2014 to remind him that he should pay his federal taxes. Bowman also has penalties, lien filings, and intended collection actions.

Matthew Schindler, Bowman's defense lawyer, argued in turn that the fundamental action of depositing checks and subsequent withdrawal of cash from the account cannot be constituted a crime. He reminded the judge that all checks received by Bowman for his professional work were disclosed to the IRS. Judge Mosman agreed and dismissed this charge sans prejudice.